热点栏目

自选股

数据中心

行情中心

资金流向

模拟交易

热点栏目

自选股

数据中心

行情中心

资金流向

模拟交易

RMB交易与研究

An opaque group of algorithmic money managers have seized control of the oil market.

一群不透明的算法基金经理已经控制了石油市场。

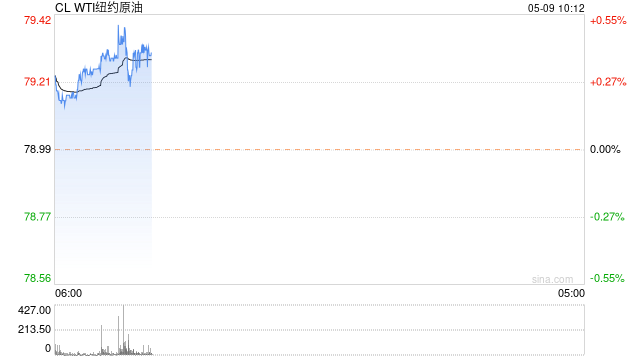

Trading oil has perhaps never been more of a roller coaster ride than it is today.石油贸易也许从来没有像今天这样像坐过山车一样。

Just in the past two months, prices threatened to reach $100 per barrel, only to whipsaw into the $70s. On one day in October, they swung as much as 6%. And so far in 2023, futures have lurched by more than $2 a day 161 times, a massive jump from previous years.就在过去两个月,油价曾一度升至每桶 100 美元,但随后又飙升至每桶 70 美元。10 月的一天,它们的波动幅度高达 6%。2023 年迄今为止,期货价格每天上涨超过 2 美元的次数已达 161 次,较往年大幅上涨。

What’s happening can’t be entirely explained by OPEC’s machinations, or war in the Middle East. While supply-and-demand fundamentals still dictate overall commodity price cycles, the day-to-day business of trading crude futures is increasingly dominated by speculative forces, fueling volatility and driving a disconnect between physical and paper markets.所发生的事情不能完全用欧佩克的阴谋或中东战争来解释。尽管供需基本面仍然决定着整体大宗商品价格周期,但原油期货交易的日常业务日益受到投机力量的主导,加剧了波动性并导致实物市场和纸质市场之间的脱节。

And it‘s not just speculators in general — traders are pointing the finger at an opaque group of algorithmic money managers known as commodity trading advisors.不仅仅是投机者——交易员还把矛头指向了一群不透明的算法资金管理者,即商品交易顾问。

Despite their mundane name, CTAs have emerged as a powerful force in the oil market. Though they comprise just one-fifth of managed money participants in US oil, CTAs made up nearly 60% of the group’s net trading volume this year by some measures, according to Bridgeton Research Group, which provides analytics on computer-generated trades. That’s the biggest share the group has held in data going back to 2017.尽管名字很平常,但 CTA 已成为石油市场上的一股强大力量。根据提供计算机生成交易分析的布里奇顿研究集团 (Bridgeton Research Group) 的数据,尽管 CTA 仅占美国石油管理资金参与者的五分之一,但从某些指标来看,今年 CTA 占该集团净交易量的近 60%。这是该集团自 2017 年以来在数据中所占的最大份额。

While it’s hard to quantify how much of total trading volumes are controlled by CTAs, algos more broadly are responsible for as much as 70% of crude trades on an average day, according to data from TD Bank and JPMorgan.根据道明银行(TD Bank)和摩根大通(JPMorgan)的数据,虽然很难量化CTA控制了总交易量的多少,但更广泛地说,算法平均每天占原油交易的70%。

“You would be absolutely shocked how large their positions are,” saidIlia Bouchouev, a former trader and managing partner at Pentathlon Investments who teaches at New York University. “They are probably bigger than BP, Shell and Koch combined.”“你会对他们的头寸有多大感到震惊,”在纽约大学任教的Pentathlon Investments前交易员兼管理合伙人Ilia Bouchouev说。“它们可能比英国石油公司、壳牌和科氏公司的总和还要大。

This year’s volatile price swings are being intensified by these bots, according to interviews with more than a dozen traders, analysts and money managers who work in the oil market. They’ve roiled commodities from gasoline to gold, sidelined traditional investors, drawn the ire of OPEC and even raised eyebrows at the White House.根据对十几位在石油市场工作的交易员、分析师和基金经理的采访,这些机器人正在加剧今年波动的价格波动。他们扰乱了从汽油到黄金的大宗商品,使传统投资者边缘化,引起了欧佩克的愤怒,甚至在白宫引起了人们的注意。

CTAs are loosely labeled as an individual or organization that advises on the trading of futures, options or swaps. But those in the know say most are defined by their trading strategies: computer-driven and rules-based, with relatively limited time horizons.CTA 被松散地标记为就期货、期权或掉期交易提供建议的个人或组织。但知情人士表示,大多数交易策略都是由他们的交易策略决定的:计算机驱动和基于规则,时间范围相对有限。

What makes algorithmic CTAs so destabilizing is that they’re typically trend followers — and trend exaggerators. When prices go down, they sell, driving them even lower. And, more troubling for consumers, the same is true on the upside.算法 CTA 之所以如此不稳定,是因为它们通常是趋势的追随者——也是趋势的夸大者。当价格下跌时,它们会卖出,从而进一步压低价格。而且,对消费者来说更令人不安的是,从好的方面来看也是如此。

Some analysts say CTAs contributed to overvaluing oil by as much as $7 a barrel during a recent rally. And White House officials believe they played a significant role in price run-ups during the course of 2023, according to a person familiar with the matter.一些分析师表示,在最近的一次反弹中,CTA导致油价高估了每桶7美元。据一位知情人士透露,白宫官员认为,他们在 2023 年的价格上涨中发挥了重要作用。

Even $1 or $2 added to the price of a barrel filters down to consumers through higher fuel costs at a time when energy-driven inflation is among the biggest obstacles for the world’s central bankers. In August, for example, higher prices meant that gasoline costs accounted for half of the increase in the US consumer price index.在能源驱动的通货膨胀是世界央行行长面临的最大障碍之一的时候,即使是每桶价格增加1美元或2美元,也会通过更高的燃料成本过滤到消费者身上。例如,8月份,价格上涨意味着汽油成本占美国消费者价格指数涨幅的一半。

“The Federal Reserve should be aware of them and their influence in markets,” saidRebecca Babin, a senior energy trader for CIBC Private Wealth in New York.“美联储应该意识到它们及其对市场的影响力,”CIBC Private Wealth驻纽约的高级能源交易员Rebecca Babin表示。

“CTAs can create these fractures — periods of time when we’re trading away from fundamentals,” Babin said. And while those moments may be short-lived, the ensuing price swings “read through into the broader economic world in a lot of different ways,” she said.“CTA可能会造成这些裂缝 - 我们远离基本面的时期,”巴宾说。她说,虽然这些时刻可能是短暂的,但随之而来的价格波动“以许多不同的方式渗透到更广泛的经济世界中”。

Big Swings, Big Profit动,大利润

While algorithmic CTAs add much-needed liquidity to the market, their trading strategies can amplify daily swings to an extreme. In 2022, when CTA trading volumes rapidly expanded, New York oil futures posted a more-than $2 daily move 242 times. That’s 150% higher than the historical average since 2000, according to Bloomberg calculations.虽然算法 CTA 为市场增加了急需的流动性,但它们的交易策略可能会将每日波动放大到极端。2022 年,当 CTA 交易量迅速扩大时,纽约石油期货的日涨幅超过 2 美元,上涨了 242 次。彭博社计算,这比2000年以来的历史平均水平高出150%。

But what’s so surprising about the continued volatility in 2023 is that it’s come without the major shock to supplies that followed Russia’s invasion of Ukraine. While Israel’s conflict with Hamas set markets on edge, it’s not yet had any major impact on oil flows. And rallies buoyed by production cuts from the Organization of Petroleum Exporting Countries and its allies have been undercut by CTA activity.但令人惊讶的是,2023 年的持续波动并没有像俄罗斯入侵乌克兰后那样对供应造成重大冲击。虽然以色列与哈马斯的冲突使市场处于紧张状态,但它尚未对石油流动产生任何重大影响。石油输出国组织(Organization of Petroleum Exporting Countries)及其盟国减产提振的反弹也被CTA活动所削弱。

The unpredictability of this year’s market swings haven’t been kind to human traders, many of whom are making less money on oil than they did last year when they raked in record gains, according to market participants.据市场参与者称,今年市场波动的不可预测性对人类交易员来说并不友好,他们中的许多人在石油上赚的钱比去年创纪录时少。

CTAs, by contrast, have been booming — notching three straight years of gains in energy markets, according to Stephen Roseme of Bridgeton.相比之下,CTA一直在蓬勃发展——根据布里奇顿的斯蒂芬·罗斯姆(Stephen Roseme)的说法,能源市场连续三年上涨。

And many CTAs are expanding. Paris-based Capital Fund Management says its CTA’s assets under management jumped to $3.8 billion in July 2023 from $2.4 billion in December 2021. Amapa Capital Advisors LLC and Skylar Capital Management are among CTAs that have doubled or tripled assets under management in less than two years, CTA advisory firm IASG reports. The largest CTAs in energy are Man AHL, Gresham, Lynx and AlphaSimplex, according to BarclayHedge, but their exact volumes are difficult to quantify.许多 CTA 正在扩大。总部位于巴黎的资本基金管理公司表示,其CTA管理的资产从2021年12月的24亿美元跃升至2023年7月的38亿美元。据CTA咨询公司IASG报道,Amapa Capital Advisors LLC和Skylar Capital Management是CTA之一,在不到两年的时间里,管理的资产增加了一倍或三倍。根据BarclayHedge的数据,能源领域最大的CTA是Man AHL,Gresham,Lynx和AlphaSimplex,但它们的确切数量很难量化。

Man Versus Machine人与机器

The beauty of algorithmic CTAs, according to the humans behind them, is that they’re untainted by bias and impulse — they’re predominately mathematical. That approach, of course, is anathema to many in commodities, where man’s dominion over nature, and markets, is foundational.根据算法CTA背后的人的说法,算法CTA的美妙之处在于它们不受偏见和冲动的影响——它们主要是数学的。当然,这种方法对许多大宗商品来说是诅咒的,因为在大宗商品中,人类对自然和市场的统治是基础。

“Every trader thinks they’re the best. Every trader thinks they have the edge,” says Brent Belote, who gave up an oil trading career at the biggest US bank,JP Morgan Chase & Co, to launch his own CTA in 2016.“每个交易者都认为自己是最好的。每个交易员都认为他们有优势,“布伦特·贝洛特说,他放弃了美国最大的银行摩根大通的石油交易生涯,于2016年推出了自己的CTA。

Trusting a machine didn’t come naturally to Belote. Although he’s built six algos, he initially found himself trading alongside them. After all, he had years of expertise that the computer did not.贝洛特并不自然而然地相信机器。尽管他已经构建了六种算法,但他最初发现自己是在与它们一起进行交易。毕竟,他拥有计算机所没有的多年专业知识。

When Russia invaded Ukraine in early 2022 and Brent crude futures skyrocketed 35% to trade above $120 a barrel, Belote wanted desperately to direct his algos. It was a subzero morning in Jackson, Wyoming, when he rose to check on his models – but he decided not to intervene. In the aftermath of the invasion, his firm,Cayler Capital, returned 25% to investors, he said. That compares with 1% for Bloomberg’s hedge fund index.当俄罗斯于 2022 年初入侵乌克兰、布伦特原油期货价格飙升 35% 至每桶 120 美元以上时,贝洛特迫切希望指导他的算法。那是怀俄明州杰克逊的一个零下的早晨,他起身去检查他的模型,但他决定不干预。他说,入侵之后,他的公司凯勒资本 (Cayler Capital) 向投资者返还了 25%。相比之下,彭博对冲基金指数为 1%。

“The numbers don’t lie,” said Belote.

“数字不会说谎,”贝洛特说。

Not ‘Flash Boys’不是“闪光男孩”

CTAs themselves aren’t new — they’ve been around since the early days of futures trading. And since 1984, they’ve had to register with the National Futures Association. They typically enjoy a lower barrier to entry than hedge funds, which can trade a wider variety of securities and require more initial capital.CTA 本身并不新鲜——它们从期货交易的早期就已经存在了。自 1984 年以来,他们必须在全国期货协会注册。与对冲基金相比,它们的进入门槛通常较低,对冲基金可以交易更广泛的证券,并且需要更多的初始资本。

They’re not really the “Flash Boys” of futures, though. CTAs, unlike high-frequency traders, aren’t typically profiting from the speed at which they move. Instead, they mostly make money on indicators fueled by trends. And they’re active in equities and commodities alike through futures and options.不过,他们并不是真正的未来“闪光男孩”。与高频交易者不同,商品交易顾问通常不会从交易速度中获利。相反,他们主要通过趋势推动的指标赚钱。他们通过期货和期权活跃于股票和大宗商品领域。

Markets for commodities, however, differ from equities in many important respects. For example, while the stock market evolved as a way to raise capital, commodities futures markets have traditionally been a place for producers and buyers to hedge their price risk.然而,大宗商品市场在许多重要方面与股票市场不同。例如,虽然股票市场是作为筹集资金的一种方式而发展的,但商品期货市场传统上一直是生产商和买家对冲价格风险的场所。

Born From the Crash从崩溃中诞生

How did CTAs come to become so dominant? Like many current phenomena, the answer starts in the depths of the pandemic.CTA 为何变得如此占主导地位?与当前许多现象一样,答案始于大流行的深层原因。

As shutdowns engulfed the world in 2020, fuel consumption collapsed by more than a quarter. All hell broke loose in the crude market. The benchmark US oil price briefly dropped to minus $40 a barrel and investors were in wholly new territory. Some funds that took longer-term views based on supply-and-demand fundamentals quickly pulled out.2020 年,随着全球范围内停工,燃料消耗下降了四分之一以上。原油市场彻底崩溃了。美国基准油价短暂跌至每桶负 40 美元,投资者进入了全新的领域。一些基于供需基本面采取长期观点的基金迅速撤离。

Such bear markets proved to be “extinction events” for traditional funds, which made way “for algo supremacy,” the bulk of which are CTAs, saidDaniel Ghali, senior commodity strategist at TD Securities. Russia’s invasion of Ukraine gave the CTAs another foothold. Spiking volatility in the futures market drove many remaining traditional investors to the exits, and open interest in the main oil contracts tumbled to a six-year low.道明证券(TD Securities)高级大宗商品策略师丹尼尔·加利(Daniel Ghali)表示,这种熊市被证明是传统基金的“灭绝事件”,为“算法霸权”让路,其中大部分是CTA。俄罗斯对乌克兰的入侵为 CTA 提供了另一个立足点。期货市场的剧烈波动迫使许多剩余的传统投资者退出,主要石油合约的未平仓合约跌至六年低点。

That coincided with the collapse of another source of futures and options trading: oil-production hedging. During the heyday of shale expansion about a decade ago, drillers would lock in futures prices to help fund their growth. But in the aftermath of the pandemic-induced price crash, a chastened US oil industry increasingly focused on returning cash to investors and eschewed hedging, which can often limit a company‘s exposure to the upside in a rising market. By the first quarter of this year, the volume of oil that US producers were hedging by using derivatives contracts had fallen by more than two-thirds compared with before the pandemic, according to BloombergNEF data.与此同时,期货和期权交易的另一个来源:石油生产对冲也崩溃了。大约十年前,在页岩气扩张的鼎盛时期,钻探商会锁定期货价格,为其增长提供资金。但在大流行引发的价格暴跌之后,受到打击的美国石油行业越来越注重向投资者返还现金,并回避对冲,这往往会限制公司在上涨的市场中的上行风险。彭博新能源财经的数据显示,到今年第一季度,美国生产商利用衍生品合约进行对冲的石油量比疫情爆发前下降了三分之二以上。

The recent wave of dealmaking by US oil producers threatens to further accelerate the decline in hedging. And it’s highly likely that CTAs will continue to fill the vacuum left by those traditional market players.美国石油生产商最近的交易浪潮有可能进一步加速对冲的下滑。CTA 很可能会继续填补这些传统市场参与者留下的真空。

In some ways, the rise of the CTAs is just starting. That’s evident to Bouchouev of NYU, who says that his students consider working at the funds a “dream job.”从某些方面来说,CTA 的崛起才刚刚开始。对于纽约大学的布霍耶夫来说,这一点显而易见,他说他的学生认为在该基金工作是一项“梦想的工作”。

“CTAs are an example of how technology is getting into our space,” he said. “You’d be a dinosaur after a while if you reject it.”“CTA 是技术如何进入我们领域的一个例子,”他说。“如果你拒绝它,过一段时间你就会变成恐龙。”

(原文来源于BBG网络版,以英语专业学习为目的)